Spring Budget: How to use your allowances to keep more of your profits

The past few years have been a tough time for small business owners, from the knock-on effects of the Covid-19 pandemic to the continuing cost of living crisis. So, you’ll be pleased to know that some of the updates announced by Jeremy Hunt in his recent spring Budget could be very good news if you run your own business.

The changes announced to pensions and tax relief are especially significant and could allow you to use more of your hard-earned profits to generate a healthy lump sum for retirement. Read on to discover exactly what was announced in the spring Budget and some practical ways to make the most of your allowances this tax year.

The spring Budget contained lots of significant pensions and tax updates

The chancellor announced a raft of changes to pensions and taxes in his spring Budget, and many of them are especially significant for business owners. Here are some of the changes that could have an impact on you.

1. Lifetime Allowance tax charge removed for 2023/24

In previous tax years, the Lifetime Allowance (LTA) meant that if your pension pot exceeded a certain threshold, you would have incurred an additional tax charge when you withdrew from your funds. In 2022/23, the LTA was £1,073,100.

The chancellor has removed the tax charge that applied to the LTA for the tax year 2023/24 with a plan to abolish the LTA in April 2024. This means that, subject to annual limits, you can now save an unlimited amount of money in your pension across your lifetime without incurring additional tax charges.

2. Annual Allowance increased to £60,000

The Annual Allowance (AA) is the amount that you can contribute to your pension each tax year and still receive tax relief at your marginal rate. If you contribute more than the AA in a tax year, you may be subject to an additional tax charge.

In previous years, the allowance was £40,000, but for 2023/24 the chancellor has increased the allowance to £60,000. This means that you can now receive tax relief on a higher amount of pension contributions, making saving for retirement even more tax-efficient.

3. Corporation Tax increase to 25% going ahead

After remaining at a flat rate of 19% for some time, the Corporation Tax rate will increase in the tax year 2023/24. From 1 April 2023 Corporation Tax will be split into bands as follows:

- Companies that have profits of £250,000 or more will be charged Corporation Tax at the main rate of 25% of all profits.

- Companies that have profits of £50,000 or below will be charged a “small profits rate” of 19% on all of their profits.

- Companies whose profits fall somewhere in between these two thresholds will be charged at an effective marginal rate of 26.5%.

So, if you expect to generate profits in excess of £50,000 a year, this change may affect how you decide to use profit from your business in the future.

The changes could affect how you decide to use profits from your business

One way to illustrate the true impact the changes to pension tax relief and Corporation Tax rates could have is to consider the different ways you could extract profit from your business.

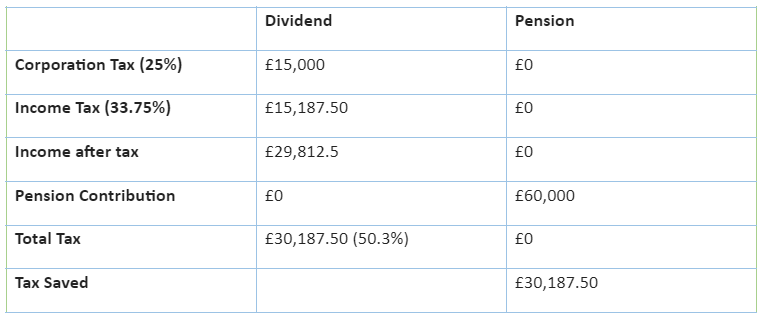

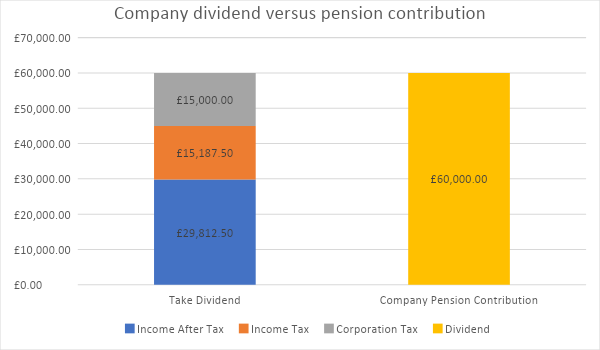

Let’s say that your business has made a profit of more than £250,000 this tax year and you’ve already exceeded your Personal Allowance. After taking care of your other priorities, you decide to extract £60,000 of that profit from your business. But what would be the most tax-efficient way to do this?

1. You could take the profit as a bonus

If you decide to take £60,000 of profit from your business as a bonus, this is treated as taking a salary. This means that the lump sum would be business cost and reduce the Corporation Tax at a rate of 25%. However, the business and you as an individual would be taxed for employer and employee National Insurance contributions (NICs).

After this, you would also need to factor in Income Tax at your marginal rate.

2. You could take the profit as dividends

When your business is in profit, you can extract some of this profit as dividends. Unlike taking a salary from your business, dividends don’t require you or your business to pay NICs. However, if you extracted your £60,000 in this way, your money would be subject to Corporation Tax at 25%, and you would then be liable to pay Dividend Tax at your marginal rate.

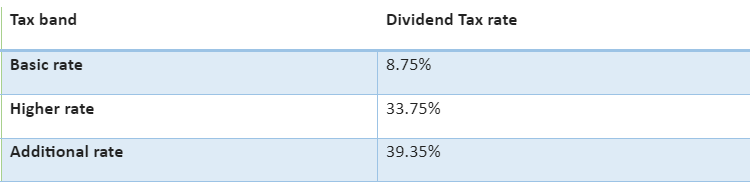

Remember that the Dividend Allowance for the tax year 2023/24 has been reduced to £1,000. So, any dividends you take that exceed this threshold are taxed as follows:

Note: if you are a higher- or additional-rate taxpayer, paying yourself a bonus may be more tax-efficient than taking the company dividend once you take the business and personal taxes together into consideration in this example.

3. You could save the entire lump sum into your pension

For the business, employer contributions made to the pension can be eligible for Corporation Tax relief since it is an allowable business expense.

So, in this scenario, you could potentially retain the full amount of £60,000 inclusive of the tax relief that you would claim on your contribution.

Company dividend versus pension contribution

£60,000 profit taxed as at the higher-rate taxpayer

The Lifetime Allowance change could be very beneficial for estate planning

While the AA increase is likely to benefit you immediately, the removal of the LTA tax charge for 2023/24 and potential abolition of it in April 2024 could have long-term benefits for your estate planning. Without the prospect of a tax charge for exceeding the threshold of the LTA, you can invest as much as you like (subject to annual limits) into your pension across your lifetime.

While this will have obvious benefits for your retirement and ensuring you have enough saved to afford the lifestyle you would like to lead, there are also implications for your estate plan.

Pensions are usually considered to be outside of your estate for Inheritance Tax (IHT) purposes after you pass away. In the past, the LTA meant that you could only save a set amount into your pension and subsequently pass on to your loved ones tax-efficiently.

But now that the tax charge has been removed, you could use your pension to pass on more of your wealth to beneficiaries if you want to reduce the IHT liability of your estate.

Keep in touch with your financial planner to stay abreast of any updates to legislation

The changes you’ve read about in this article are specific to the 2023/24 tax year. However, the LTA abolishment is yet to be brought into legislation and Labour has already stated it would reverse this change if they came into power. So, it’s important to continue to liaise with your financial planner to make sure you are managing your money in the most tax-efficient way possible.

Say hello to us [email protected], call us on 0161 541 2826 or submit a contact form on our website.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.