SIPP versus SSAS – how to determine which pension is right for you

Your pension is likely to be one of the most important investments you’ll make during your life, since it could provide the majority of your income during retirement. That’s why it’s crucial that you invest in the right scheme for your circumstances.

As a business owner, there are several options that could be worth considering because of the benefits they offer to your business as well to you personally. Read on to learn more about self-invested personal pensions (SIPPs) and small self-administered schemes (SSASs) to see if one might be right for you.

A SIPP offers flexibility without day-to-day admin responsibility

A SIPP is a type of pension “wrapper” that can be set up with an insurance company or a specialist SIPP provider. It’s similar to a standard private pension but offers more flexibility as to what you can invest in. For example, you could choose to invest in:

- Land or commercial property (you cannot invest directly in residential property)

- UK or overseas company shares

- Cash savings

- Investment trusts

- Collective investments.

This flexibility can provide a tax advantage specifically to business owners. By purchasing commercial property through a SIPP – for example, your own premises – any rent that you receive for those workspaces will usually go directly into the SIPP, potentially reducing the amount of Income Tax you will pay and boosting your pension pot.

Additionally, you may not need to pay Capital Gains Tax (CGT) on property sold from a SIPP, since the gains belong to the pension rather than to you as an individual. However, bear in mind that transferring a commercial property into a SIPP initially might result in a CGT charge.

There is also flexibility in how you manage your SIPP. You can either make decisions about when and where you invest the pension yourself, or you can ask a financial planner to help manage the pension for you.

When you set up a SIPP, you join an established scheme that usually has existing members. Your investments and assets are ringfenced from the other members, and the SIPP provider will often take responsibility for the day-to-day admin required to run the scheme.

This means they may submit one tax relief claim to HMRC for all the members who have made monthly personal contributions to the scheme.

It may be beneficial to ask a financial adviser to oversee your SIPP if you don’t have much experience in investment management. This is because you may have less protection if things go wrong, and you have acted without regulated financial advice.

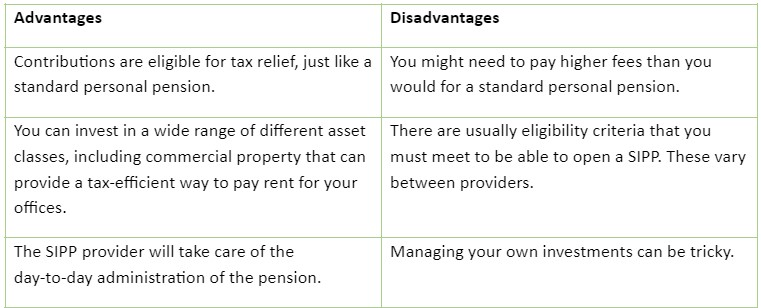

Here are some of the advantages and disadvantages of investing in a SIPP.

A SSAS is more flexible but requires more hands-on involvement

A SSAS is usually set up to allow a small number of company directors, often a maximum of 11, to save for retirement. It can sometimes be offered to employees and family members as well.

When you set up a SSAS it will need to be registered with HMRC because it is a new, individual scheme. This process can take between three and six months, although timescales vary, so bear this in mind if you need to move quickly with your plans.

One of the main benefits of these schemes is the greater degree of flexibility in what you can invest your pension in compared to a standard personal pension or even a SIPP. Since SSASs are not regulated by the FCA, there is no distinction between standard and non-standard asset classes.

This could be especially attractive for a business owner since a SSAS offers the ability to make loans to, or buy shares in, your company. This option isn’t available with a SIPP.

A SSAS tends to be managed by the individuals who are invested in it, which includes making investments, submitting returns to HMRC, and managing the tax relief. Each member is a trustee, so all documentation related to the scheme will usually need to be signed by everyone, although there may be a professional trustee to sit alongside them.

It is important to note that a SSAS member usually owns a proportion of the total pot rather than having their own allocated assets. The rules for this may vary between providers.

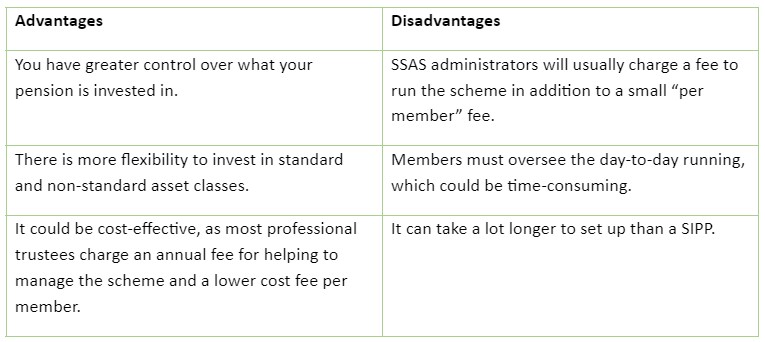

There are several advantages and disadvantages to investing in a SSAS.

Your circumstances will dictate which is right for you

While each type of scheme has its own benefits, the most suitable option for you will depend on your circumstances.

A SIPP might be a good option if you:

- Want to invest your pension in a more varied portfolio than is available with a standard personal pension

- Don’t want to be involved in the day-to-day running of your pension

- Want to keep your personal assets separate from those of your colleagues or fellow scheme members.

Whereas a SSAS might be a good option if you:

- Want to be able to loan money to, and buy shares in, your own company

- Feel confident managing the scheme alongside your colleagues

- Are happy to potentially pool your assets with those of your fellow trustees, owning a proportion of them as your pension.

It may be helpful to consult with a financial planner before making your decision, because they will be able to help you understand which route is best for your circumstances.

Get in touch

If you’d like to learn more about whether a SSAS or SIPP might be right for you, we can help. Say hello to us [email protected], call us 0161 541 2826 or submit a contact form on our website.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.