Could your business finances affect your personal wealth?

Running a business can be a positive way to boost your net worth and help you to work towards your personal financial goals.

When you run your business as a limited company, your business finances are ringfenced from your personal finances. So, even if your company fails, it is unlikely to affect your personal credit score or finances unless you have any personal guarantees on your business debts.

There are, however, a few ways that running a business could have an impact on your personal wealth and your ability to hit your long-term goals. Read on to learn some practical steps you can take to protect your financial wellbeing.

1. Under certain circumstances, you could be liable for repaying business debt

Even if you run a limited company, if your business runs into financial difficulty there are certain circumstances when you might be personally liable for repaying debt. These include the following.

Personal guarantees

If you have made a personal guarantee on a business loan that cannot be repaid, you could become liable for the outstanding amount. Personal guarantees might be required on leases, trade supplies, bank loans, and invoice financing.

If you need to make a personal guarantee on a business loan, make sure you read the terms and conditions of the agreement carefully. It might help to consult with a professional such as a solicitor or a financial planner who can help you to understand your personal liabilities and choose a provider that minimises the risk to your personal finances.

Overdrawn director’s loan account

If you borrow money from the company, this is known as an “overdrawn director’s loan account”.

It’s not a problem if the loan is repaid, but if it is still outstanding nine months after the end of the company’s financial year, HMRC may charge you Income Tax on the loan. The company could also be liable for an additional tax charge on the loan.

2. How you choose to extract profit could affect your tax position

Extracting profit from your business can be a complex process as there are several different ways you could approach it.

The three main ways to extract profit are to take it as salary, dividends, or pension contributions. Each method has its own pros and cons, but one of the things that could have the biggest impact on your personal finances is the tax efficiency of the method that you choose.

Salary

If you extract your profits as salary, both you and the business will need to pay National Insurance on the sum. You could also be liable for Income Tax at your marginal rate.

A benefit of taking a salary from the business is that you earn National Insurance credits towards your State Pension.

Dividends

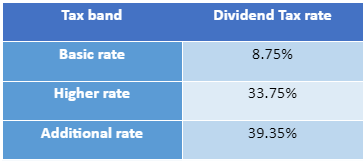

Profits that are extracted as dividends are not liable for National Insurance, but you may need to pay Dividend Tax if you exceed your Personal Allowance (£12,750 in 2023/24) and Dividend Allowance (£1,000 in 2023/24, dropping to £500 in 2024/25) for the tax year.

The rate of tax that you pay will depend on your marginal rate of Income Tax, as shown below.

Pension contributions

Opting to take your profits as pension contributions can be very tax-efficient. This is an allowable expense, so pension contributions made by the business could help reduce your Corporation Tax bill.

Neither you nor your business will pay National Insurance on pension contributions.

Income Tax is only payable on the funds that you invest in your pension when you withdraw them in retirement. As such, this could mean that you pay a lower rate of Income Tax on your business profits, since your income is likely to be lower in retirement than while you are working. Indeed, if your retirement income is below the Personal Allowance, you may not need to pay Income Tax at all.

Pensions are usually considered outside of your estate for Inheritance Tax (IHT) reasons. So, investing your business profits in this way could help to reduce the IHT liability of your estate after you pass away.

3. Your exit strategy can affect your ability to hit your long-term financial goals

The exit strategy you put in place for leaving the business when you’re ready can mean the difference between hitting your long-term financial goals and retiring with less than you need.

A key part of getting this right is to understand how much you need to make from the sale to be able to achieve your goals. Your financial planner can help you to calculate this using cashflow forecasting.

This is a tool that can show you how much income you may need throughout the different stages of your life as well as how your wealth could grow over time based on assumed investment returns and inflation.

When you have calculated this figure, you can make a much more informed decision about when to sell your business and how to prepare for the sale.

A thorough and clear succession plan can help you to avoid exiting your business at the wrong time, without sufficient funds to support your lifestyle goals.

Read more: How much money do I really need as a business owner in Manchester?

Get in touch

If you’d like support in managing your business and personal finances to help you achieve your long-term financial goals, we can help. We’re lifestyle financial planners who specialise in providing holistic, evidence-based advice to help you and your family shape the lives you’ve always wanted.

Say hello to us at [email protected], call us on 0161 541 2826 or submit a contact form on our website.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate cashflow planning.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.