Is your business benefiting from the recent interest rate rises?

Keeping some cash reserves set aside in your business is a sensible way to manage your cash flow.

Setting aside a dedicated lump sum could help you to cover costs such as hiring a new employee, replacing outdated equipment, or revamping your website. In addition to this, you may wish to keep a cash reserve to cover upcoming expenditure like your Corporation Tax and VAT.

Where you choose to hold your cash is another important decision that could help you to get even more from your money.

Over the past 15 years, the interest rates on most savings accounts have hovered near zero. But after 14 consecutive rate rises from the Bank of England, savings accounts are now offering much higher interest rates than previously. This means it’s worth shopping around to see if higher rates could enable you to use your cash more effectively.

Read on to learn more about the different options available to you for holding short-term cash reserves that could help you to manage your business finances more effectively.

There are different types of business savings accounts to choose from

Just like in the personal banking sector, you have a few options to choose from when selecting a savings account for your business. What is suitable for your business will depend on a few factors, such as:

- How often you might need access to your cash

- How much cash you have available to save

- How quickly you need to be able to withdraw cash from the account.

The three main types of savings accounts are as follows.

Easy access savings account

This type of accounts allows you to withdraw from your balance as often as you like with no notice period or limit to how much of your money you can access. The interest rate may be lower than on other types of savings accounts because of the flexibility you have.

According to Moneyfacts, as of 9 August 2023, the highest interest rate on an easy access business savings account was 3.2%.

Notice accounts

As the name suggests, you’ll need to give notice before withdrawing any money from these types of accounts, but different providers have different notice period requirements. Interest rates may be higher on these accounts than easy access savings accounts, but they can be variable based on how much and when you choose to withdraw from your savings.

According to Moneyfacts, as of 9 August 2023, the highest interest rate on a notice account for businesses was 5.25%.

Fixed-term savings

Fixed-term savings accounts require you to leave your money in your account for a certain period of time before you are permitted to withdraw anything. This often means that the interest rates are higher than easy access savings accounts or notice accounts. You will need to be confident that you won’t need to access any money you deposit because early withdrawals aren’t usually possible.

According to Moneyfacts, as of 9 August 2023, the highest interest rate on a two-year fixed-term account for businesses was 6%.

An investment platform could be a convenient way to hold your cash reserves alongside other accounts

Another way that you could hold your cash savings is on an investment platform.

Investment platforms offer a wide range of tax-efficient wrappers to choose from for your personal and business finances. As well as holding any investments that you may have for yourself or for your business in the form of corporate investing, an investment platform may also enable you to hold cash savings.

Similar to an instant access bank savings account, this cash account is available to withdraw at any time. As an example, one of our preferred platforms that we use for our clients is offering 4% on any cash deposits currently (August 23).

It’s important to note that you may need to pay fees for an investment platform, so it’s sensible to consult a financial planner to learn whether this is a suitable choice for you.

You may require several different types of accounts to hold cash for different reasons

As a business owner, it’s likely that you will hold several cash reserves for different reasons, including:

- VAT

- Corporation Tax

- Retained profits

Below is an example to demonstrate how the different types of accounts you’ve read about above could be used to separate your cash reserves versus storing all of them in one easy access business savings account.

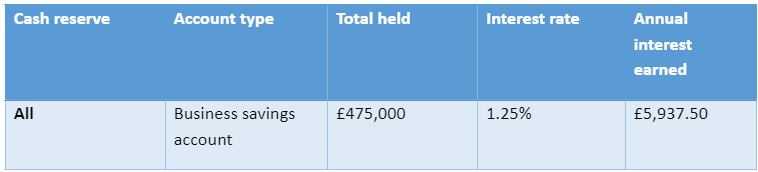

Current solution

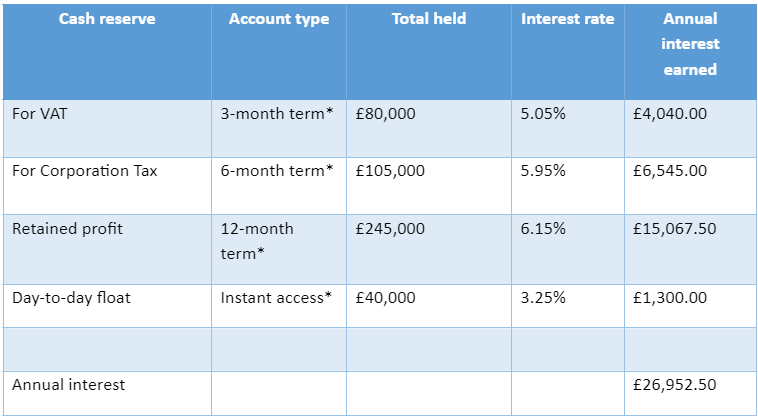

New solution

*Assumed rolling terms over an annual basis

By using the new solution and holding each type of cash reserve separately in a suitable savings wrapper, the interest earned was £21,050 more than the interest earned in the first example.

Treasury management can help you get the most out of your business finances

Treasury management is often overlooked, particularly by small businesses, but it can play a vital role in keeping your cash flow and profits healthy.

Treasury management encompasses a range of tasks, including:

- Managing payroll

- Overseeing accounts payable and accounts receivable

- Reviewing and upgrading systems where necessary

- Security and fraud prevention.

By keeping on top of these tasks, you can ensure that the cash in the bank is working hard for you. Moreover, you can make sure that your business stays on the right side of the interest rates.

When interest rates are high, it becomes more expensive to borrow money. So, paying off debts in a timely manner can help you to reduce the amount of interest you pay on credit.

There are lots of different treasury management solutions available to support you in this area. It may be worth considering an automated system or even outsourcing your treasury management. This can help to minimise the amount of interest your business needs to pay on invoices and maximise the interest you earn on cash reserves.

Get in touch

If you’d like to learn more about how to take advantage of the recent interest rate rises to boost your business’ cash reserves, we can help.

Say hello to us at [email protected], call us on 0161 541 2826 or submit a contact form on our website.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.