5 tax-efficient ways to use surplus cash in your business

As the owner of a company, you might find yourself with surplus cash in your business at certain points in the year.

Surplus cash should not be confused with funds that are required later in the year, such as funds for paying your Corporation Tax or VAT bill. Instead, surplus cash refers to retained profits that aren’t required to pay other bills.

So, if you still have some cash left over once all of those bills are accounted for, what should you do with it? Read on for five tax-efficient ideas that could benefit you and your business.

1. Invest it into your pension

If tax efficiency is a priority for you, then investing into your pension is a great way to use your surplus cash.

Making company pension contributions can save businesses tax as they are treated as an allowable business expense, reducing the Corporation Tax bill (from April 2023 this could be as high as 25%)

Pension contributions made through a limited company are usually more tax-efficient than making contributions from personal funds as the contribution is tax-free and the pension can grow tax-free.

A business can pay up to £40,000 a year into a pension, which is tax-free as long as it does not exceed the Annual Allowance. This can be increased to £160,000 by making use of the carry-forward rule.

It is advisable to seek specialist advice from an independent financial adviser due to the complex nature of pension schemes.

2. Build up your emergency cash reserves

Emergency cash reserves are an important part of planning for the future and protecting your business finances from unexpected bills or periods of lower income.

As a rule of thumb, having the equivalent of three to six months’ worth of operating costs set aside as emergency cash is a good idea. This provides a healthy buffer that you can rely on during hard times, giving you peace of mind that you could cope with whatever challenges your business comes up against.

3. Invest in your business

Sometimes, reinvesting surplus cash back into your business can help you to reach new goals or milestones by boosting the efficiency or profitability of your venture.

For example, if you were to invest in hiring a new team member to focus on a specific revenue-generating area of the business, the return on investment of their salary and recruitment costs could be high.

Or perhaps your marketing spend could increase slightly, in turn attracting more prospects who can be converted into clients. If you’ve been reliant on word-of-mouth to attract new customers until now, this might be a very useful way to use your surplus cash.

If you do decide to reinvest the cash, make sure you take the time to identify which area of the business would benefit most and what actions are most aligned with your business goals.

4. Take it as salary or dividends

Sometimes, you might want to reap the rewards of your hard work and take some or all of the surplus cash from your business as salary or dividends.

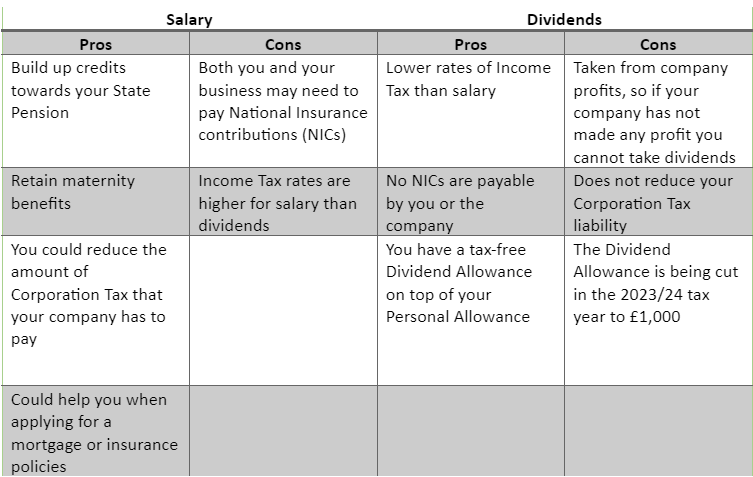

Your personal circumstances and business goals will dictate which option is most suitable for you, since there are pros and cons to each method of paying yourself. You can view some of them in the table below.

5. Consider corporate investing

Once you’ve taken care of all the above points, you might want to consider corporate investing.

Corporate investing means investing your cash into other businesses or funds in order to (hopefully) generate returns. It can be a useful way to create an additional revenue stream for your business and give your cash a chance to grow rather than simply sitting in a cash savings account.

You could invest in a fund, individual stocks, trusts, or bonds. Choosing which investments are best for your business can be tricky, so consider consulting a financial planner to help you choose a portfolio that offers the right level of risk.

There are of course some drawbacks to corporate investing that you should be aware of. As with all investments, it does carry a certain level of risk. The value of your investments can go down as well as up, and you may not get back what you originally invested.

Additionally, investing should be seen as a long-term strategy, so it’s important to only invest money that you don’t need access to in the near future.

Get in touch

If you’re a business owner looking for help with your personal or business finances, we can help. Say hello to us at info@chapter3fp.co.uk, call us on 0161 541 2826 or submit via the contact form on our website.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.